|

New IRmep book now available!

on Twitter!

Audio

|

Waste Driven Demand Raises Petroleum Prices:

How Congressional SUV Subsidies Increase Prices at the Pump

PDF/Printable

The New Reality

of Permanently High Petroleum Prices

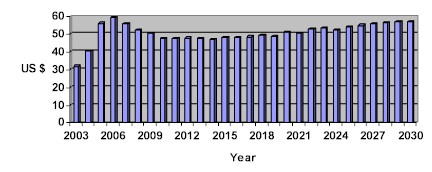

On December 12, 2005, the US Energy Information Administration (EIA) released a revised

oil price forecast through year 2030. On the supply side EIA sees increased use of coal

and nuclear energy as OPEC output grows more slowly than previous estimates. Most jarring

to American consumers is a $21 jump in per barrel prices. (See Exhibit #1) The revised

forecast also predicts increasing reliance on foreign energy suppliers even as the US

increases domestic production.

Exhibit 1: 2003-2030 Forecast Imported Light Crude Price per

Barrel

(Source: EIA Annual Energy Outlook 2006)

Past EIA forecasts have underestimated future petroleum prices. Nevertheless, normally

market savvy competitors such as GM and Exxon have not strategically realigned their

operations or expectations to higher petroleum prices, producer country maturation and

market demand issues. Their missteps have been heralded by the simplistic, yet erroneous,

drumbeat of supply side mythologies promoted by mainstream American policy think tanks.

Their misconceptions are echoed by politicians throughout the news media. The core

mainstream think tank analysis is threefold. First, they would have Americans believe that

energy prices are primarily a supply side phenomenon. Second, they propose that the price

of Middle East petroleum is too high and could return to lower levels if only the demands

of state owned national oil companies managing the majority of global production could be

reigned in. Finally they postulate that US energy demand can and should shift away from

Arab producers as an effective way to "fight terrorism". (See Exhibit #2)

These fundamentally flawed, and somewhat racist, arguments put basic economic principles

on the defensive by ignoring demand side factors.

Exhibit 2: Mainstream Think Tanks Obsession: Supply Side Energy Factors

(Source: AEI, Heritage, MEF, Brookings)

Think Tank |

Study/Author/Date |

Perspective |

American Enterprise Institute |

"Oil and Stagflation"

John H. Makin

8/20/2004 |

“The rising

oil price becomes a brake on demand growth by taxing consumers and producers. Higher oil

prices have already reduced U.S. household incomes by about $40 billion this year, at

about an annual rate of $80 billion or 0.8 percent of GDP.” |

Heritage Foundation |

"Increasing the Global Fuel

Supply"

Ariel Cohen

11/30/2005

|

“National oil

companies control 58 percent of oil and natural gas reserves. In many of those countries,

laws actually require that the government own or control significant shares of any

oil-exploration ventures. But corruption in those very governments makes the multi

billion-dollar investments required for oil exploration too risky.” |

Middle East Forum |

Mission Statement

Daniel Pipes

2005

http://www.meforum.org |

“….reducing

funds going to the Middle East for energy purchases.” |

Brookings Institute |

“Vote Yes for the Energy Bill,

Then Start Working on the Real Issues”

Gregg Easterbrook

7/28/2005 |

“If all new

cars, pickup trucks had roughly one-third higher fuel economy it would take less than 10

year's worth of new-vehicle sales to displace consumption equal to the among the US

currently imports from Persian gulf dictatorships.

This would be

fabulous for US national security, while reducing total global greenhouse gas emissions

and reducing the amount of dollars that flow to the oil sheiks who fund terrorism”

|

The Demand Side of the Petroleum Price Equation

Although mainstream American think tank energy price analysis focuses on the "supply

curve", demand side issues are clearly a driving force in rising prices. The US and

emerging Asia have the largest forecast increase in global petroleum demand, which

required 84 million barrels per day in 2004, but will require 111 million barrels per day

in 2025. With major OPEC and other production lagging, simple economics dictate

that in the face of spiraling demand, energy prices must rise.

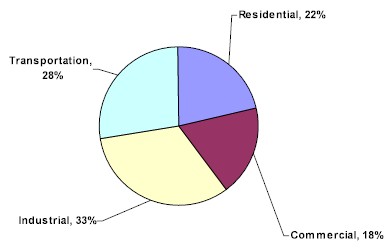

The highest US energy consumption sector is transportation followed by industry,

residential and commercial sectors. Consumers looking for ways to cut their energy bill in

2006 have logically started in the garage: gasoline expenditures represent 61% of the

transportation sector energy outlay. (See Exhibit #3)

Exhibit 3: 2005 Delivered US Energy Consumption by

Sector

(Source: EIA Annual Energy Outlook 2006)

Tragically, US consumers have had to suffer the efforts of think

tanks, automakers, labor unions and the US Congress. All have worked to push through

preferential subsidies promoting light trucks over fuel efficient passenger vehicles.

Highly profitable SUV vehicle sales climbed 250 percent in the United States between 1995

and 2002. US automakers have been reticent to realign themselves with a future dominated

by higher gasoline prices. As US automakers resisted increases in the Corporate Average

Fuel Economy (CAFE) mileage standards, foreign competitors such as Honda and Toyota made

major investments in hybrid technology. US passenger automobile standards, set at 27.5 MPG

have not increased since the 1986 model year.

Even as gasoline prices steadily rose from late 2003 to mid 2004 , US automakers and the

United Auto Workers (UAW) eagerly lobbied for the passage of the “American Jobs

Creation Act of 2004”. This law introduced a massive US market distortion in the form

of a tax preference for businesses purchasing SUVs and pickup trucks, rather than

passenger cars. Although many small businesses needing hauling capacity benefited from the

break, the tax benefit also put fuel inefficient SUVs into the hands of traveling sales

people, accountants, realtors and other service providers who, absent the law's market

distortion, would have responded to rising gas prices by purchasing fuel efficient

vehicles. Those high mileage business people that purchased a SUV for the tax benefit over

a typical hybrid passenger car would consume three times as much gasoline and pay

considerably larger gas bills for accepting the Congressional subsidy. Collectively,

they shift the petroleum demand curve and raise gasoline prices.

Exhibit 4: 2006 Toyota Prius vs Chevy Tahoe Fuel Consumption Costs

(Source: Cars.com, EIA and IRmep)

|

Chevy Tahoe |

Toyota Prius |

Base 2006 Model Sticker Price |

$35,915 |

$21,725 |

City MPG |

16 |

60 |

Highway MPG |

20 |

51 |

Total 2005-2009 fuel cost at 25,000

miles per year, split between city and highway. |

$15,753 |

$5,078 |

Curb Weight |

4,978

lbs

|

2,921

lbs |

Tax Preferences |

Preferential "equipment" tax

deduction allowing accelerated depreciation for business vehicles.

Ability to deduct full vehicle cost

in 2003, $25,000 thereafter. |

Standard business depreciation schedule, eligible for

a "clean fuel" deduction of $2,000 if placed in service by the end of 2005.

Starting Jan. 1, 2006, buyers of some hybrid vehicles get a tax credit, subject to the

first 60,000 vehicles per manufacturer and buyer's AMT status. |

Some US auto makers, led by Ford, are now retooling a bloated and

stagnating product line. In the year 2000, while many American manufacturers saw

innovation as a 10 cylinder gasoline engine for the consumer light truck market, Toyota

was quietly launching hybrid vehicles worldwide. Even now, when the fuel inefficiency of

the US vehicle fleet is considered to be appalling by many consumer groups and some

members of Congress, GM is still attempting to defy gravity.

Exhibit 5: 2004 Pickup Truck Fuel Efficiency (8-Cylinder)

(Source: Cars.com)

Make |

Model |

City Miles per Gallon |

Highway Miles per Gallon |

Dodge |

Ram |

9 |

11 |

Chevrolet |

2500 HD

Silverado |

10 |

12 |

GMC |

C1500

Sierra |

11 |

14 |

Ford |

F-150 |

11 |

15 |

Amid plummeting SUV sales General Motors launched a marketing blitz

on December 27, 2005 seeking to change the perception of GM SUVs from gas guzzler to

"fuel efficient". GM will tout the Chevy Tahoe's 16 mpg city/18 highway against

the Toyota Sequoia's 15/18 performance as well as harvest public misperceptions that SUVs

offer more safety to child passengers (they do not). Toyota is choosing not to compete in

this type of marketing hair splitting, but rather continues to focus on fuel efficient

mini SUV's and hybrid product lines as it sprints to first place in the world market.

Further behind the scenes, a larger battle is raging that determines the profitability of

major American oil companies.

National Oil Companies and Rates of Return

State owned national oil companies are under the supply side spotlight of mainstream think

tanks. The world's greatest reserves of petroleum belong to national oil company Saudi

Aramco, while the leader in natural gas is Russia's Gazprom. Even in Western Europe the

largest producer is Norway's national oil company, Statoil. Many are portrayed by think

tanks as "inefficient" or "socialistic" through a hostile ideological

lens that masks the real rate of return issues at the heart of their dealings with private

oil companies.

Venezuela's national company Petroleros de Venezuela, S.A. (PDVSA) and wholly owned

subsidiary CITGO distribution company has received the most negative press. PDVSA's social

programs such as distributing below market rate heating oil allotments to low income

Massachusetts and New York residents seek to reverse negative sentiments in the US. The

Bush administration's push for the free market over socialism questions Chavez's use of

PDVSA funds going toward welfare programs. Like many national oil companies, PDVSA's

relations with major western petroleum companies have become increasingly confrontational

as the era of global oil exploration has been increasingly supplanted by production of

known reserves. Venezuela passed a law in 2001 requiring the reevaluation of all

production contracts with foreign companies to determine whether they are

"proper". This lead to a direct confrontation with Exxon-Mobil, which

transferred its stake in Venezuela's Quiamare-La Ceiba oil field just before January 1,

2006 rather than renegotiate rate of return.

Think tanks frame the Iraq oil debate around the need for "shaping" the future

of any national oil company in Iraq away from a "socialist" outcome similar to

Venezuela. US oil companies and the Bush Administration are pushing for a highly

privatized petroleum production model dominated by long term Production Sharing Agreements

(PSAs) signed between Iraq and American petroleum companies. This raises the question

whether PSA's are appropriate for operating Iraq's large existing fields of proven

reserves. Production sharing agreements for oil extraction are usually signed only when

the probability of oil discovery is low and production costs are high. From the standpoint

of the Iraqi treasury and petroleum funded reconstruction, if Western companies are able

to sign recently drafted PSA's at $40 per barrel, Iraq could forgo an estimated $74-$194

billion in revenues over the lifetime of the contracts.

Beneath the mainstream think tank disdain of foreign national oil companies lays the real

disagreement: destination of oil profits. Many national oil companies are demanding lower

foreign rates of return from partner oil companies that are more in line with real costs

and historical production experience. Saudi Arabia's 2003 negotiations with American oil

companies drove many to look for higher returns from less savvy producing states. In 2003

US bidders lost the Kingdom's $25 billion integrated tender of gas and infrastructure

development projects because of their demands for excessive returns. Even as western

surrogates cried “corruption” the market proved otherwise: foreign companies

eagerly snapped up the abandoned Saudi tenders. Kuwait has also recently rejected high

rate of return PSA's with American oil companies. Rates of return and destination of

profits are the central issue between western oil companies and national oil companies,

not the smoke screen allegations of "corruption" or "mismanagement".

In Iraq's case, in exchange for American petroleum company investment in “a sure

thing”, demanded rates of return would far exceed an industry norm of 12% return on

investment, instead reaching 42% to 162%. Whether or not Iraq ultimately forms a national

oil company is beside the point: disadvantageous production sharing agreements could be

signed even with a national oil company in place. Technically, all reserves and producing

fields remain in the state's hands. In practice, most benefits and rights transfer to the

corporate holder of the PSA contract. From the perspective of foreign oil companies, if

Iraq continues to be a highly unstable security environment, verging on civil war, higher

rates of return might be warranted to cover the costs of extra security. From the

standpoint of US consumers at the gas pump, little of the global "rate of

return" squabble really matters. Whether American or national oil companies capture

the lion's share of per barrel margin, given the efficiencies of the global energy market,

American consumers will continue pay the same price at the pump.

Xenophobia Poisons the Global Energy Debate

Many American think tanks inject an added dollop of bigotry into their energy analysis.

Most involve unfounded accusations of terror financing against Arab oil producers.

Although the rest of their attention is focused on supply side issues, when they do

finally analyze demand issues, such as stricter fuel efficiency standards in the United

States, as in the case of Brookings Institution, it is couched as a strategy for fighting

"terror" and “reducing the amount of dollars that flow to the oil sheiks

that fund terrorism.”

While there is no hard evidence linking petroleum revenues to 9/11 or other horrific

attacks on the US, mainstream think tankers feel comfortable hurling accusations and

declaring oil producers "guilty until proven innocent." For many neoconservative

think tankers, “terrorism funding” goes far beyond illicit funding of terrorist

groups on the US State Department list: they chafe at all regional largesse and most

particularly funding for reconstructing Palestinian society and aid to refugees.

Unfortunately for Brookings, no amount of smear or defamation is likely to reduce

legitimate Arab donor commitment to funding Palestinians and other refugees of natural and

man-made disasters.

Recommendations

1. US consumers need to be more demanding about their vehicle

purchases: Lumbering gas guzzling behemoths produced by American auto makers are

“inefficient at any speed”. Toyota's rise to global market dominance is a signal

that market sensitive innovation and fuel efficiency are now the winning combination, not

government subsidy and wasteful consumption. Purchasing a fuel efficient car or light

truck will shift the demand curve and lower prices, in the most important energy

consumption category: transportation.

2. US Oil companies need to reevaluate

rates of return: High project rates of return better suited to the exploration

period of the early 20th century are not appropriate in many areas with proven reserves

and fewer engineering challenges. American petroleum companies would do well to reign in

their expectations and accept lower, but profitable rates of return in mature energy

supplier markets.

3. Mainstream think tanks should turn down

the xenophobia machine: The slander and constant denigration and delegitimation

of oil producers by vocal neoconservative minorities and their echo chambers in the media

obscures real energy supply and demand issues while thwarting productive communications

flow. There is no payoff for injecting racism, bigotry and xenophobia into any debate,

including global energy.

4. Congress needs to stop subsidies that

increase petroleum prices through unnecessary demand: The “American Jobs

Creation Act of 2004” legislation distorted the market by creating more demand for

gas guzzlers than the market would have otherwise dictated. The resulting shift in the

demand curve punishes all energy consumers. Congress can do auto makers and consumers a

favor by letting energy supply and market factors, rather than subsidies and

ill-considered legislation, send clear signals to the market.

Distribution

| v |

President |

v |

Department of Defense |

|

Foreign Diplomats |

| v |

House of Representatives |

|

Department of Justice |

v |

Potential Supporters |

| v |

Senate |

|

US Attorneys |

v |

Congress Watch level

supporters |

| v |

State Department |

v |

UN |

v |

Public |

Notes

http://www.heritage.org/Press/Commentary/ed120205b.cfm

Increasing the Global Fuel Supply, Heritage

http://www.eia.doe.gov/oiaf/aeo/aeoref_tab.html EIA Annual Energy Outlook 2006 Overview,

Page 4

http://www.kansascity.com/mld/kansascity/business/13543281.htm SUV, child safety myth

dispelled in latest review, Kansas City Star, 1/4/2006

http://www.ita.doc.gov/td/auto/cafe.html US Cafe Standards

http://www.gasbuddy.com/gb_retail_price_chart.aspx Historical US Retail Gasoline Prices

http://www.wtopnews.com/index.php?nid=25&sid=663065 Hybrid Car Owners May Hit Tax

Incentive Roadblock, WTOP, Washington, DC, 1/2/2006

http://www.kansascity.com/mld/kansascity/business/13543281.htm SUV, child safety myth

dispelled in latest review, Kansas City Star, 1/4/2006

http://aawsat.com/english/news.asp?section=2&id=3188 "The United States and the

Iraqi Oil Prize", 12/27/2005, Awsharq Alawsat Ghida Fakhry

http://www.globalpolicy.org/security/oil/2005/crudedesigns.htm "Crude Designs, The

Rip-Off of Iraq's Oil Wealth", Gregg Muitt, November 2005

http://www.eia.doe.gov/emeu/cabs/saudi.html Saud Arabia Country Analysis, EIA

http://www.globalpolicy.org/security/oil/2005/crudedesigns.htm "Crude Designs, The

Rip-Off of Iraq's Oil Wealth", Gregg Muitt, November 2005

http://www.brookings.edu/views/op-ed/easterbrook/20050728.htm "Vote Yes for the

Energy Bill, Then Start Working on the Real Issues, Brookings Institution, December 2005

http://www.forbes.com/markets/feeds/afx/2005/12/20/afx2406173.html GM to Defend Number 1

Position from Toyota, Forbes, 12/20/2005

Document URL:

http://IRmep.org/oilprice.htm

|

Sign

up for IRmep's periodic email bulletins!

Sign

up for IRmep's periodic email bulletins! Sign

up for IRmep's periodic email bulletins!

Sign

up for IRmep's periodic email bulletins!