|

New IRmep book now available!

on Twitter!

Audio

|

US Tax-Exempt Charitable Contributions to Israel:

Donations, Illegal Settlements and Terror Attacks against the US

PDF/Printable

Sixty Billion

Dollars for Illegal Settlements

Israeli government officials recently disclosed that at least US $60 billion has been spent financing illegal settlements in the

occupied West Bank and Gaza. According to Israeli prosecutor Talia Sasson, the Israeli government has systematically violated its own laws by

financing settlements from foreign donations, the official state budget and secret

military accounts. One global nonprofit, the World Zionist Organization, played a central

role in coordinating illegal settlement activities.

Opaque and fungible assets freed up by massive yearly US foreign aid to Israel are pouring

into settlement development and infrastructure building designed to partition key

Palestinian territories and annex others to the state of Israel. US nonprofits are

directly and indirectly financing the coordination of illegal settlement building,

encroachment, and violence against Palestinians. Recently disclosed charitable

contributions from US lobbyist Jack Abramoff laundered to finance violent armed Israeli

activity in the Palestinian territories is only the tip of the iceberg. Considered against

the findings of a groundbreaking new study revealing the causes of suicide terrorism,

Americans must confront a disturbing question: "Are tax exempt donations from

the US generating terrorist retaliation against America?"

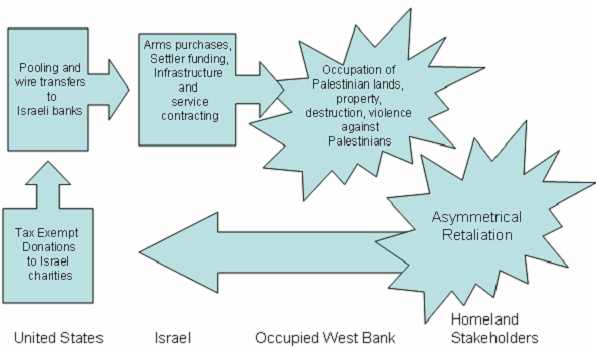

Exhibit 1: Tax Exempt Donation Laundering and Terrorism

against the US

(Source: IRmep – October, 2005)

Money Laundering, Occupation and Terrorism

Robert Pape's quantitative analysis of attacks taking place during the

years 1980 to 2003 reveal an uncomfortable truth about the root causes of suicide

terrorism: It is a strategic effort to compel target governments to withdraw forces from

land that the so-called terrorists perceive as their national homeland. Donations to tax

exempt entities in the US laundered and used to kill and maim Palestinians while

ethnically cleansing them from their homelands is not cost free to Americans. This

encroachment generates asymmetrical retaliation against soft targets in the US from

ideological stakeholders as referenced in the 9/11 Commission report.

Americans made $136 billion in tax deductible charitable contributions in 2002. A

significant portion of these contributions was aggregated by the network of tax exempt

charities operating on behalf of Israel in the United States and either transferred to

finance illegal settlements or used to fund organizations breaking US, Israeli and

international law. Tracing single $25,000 donation within this enormous flow illuminates

the important role of money laundering. (See Exhibit #2).

Washington Lobbyist Jack Abramoff laundered money from the Choctaw Chippewa Indian tribe

into a non-descript 501 (c) (3) called the "Capital Athletic Foundation" (CAF).

In addition to funding the illegal West Bank Beitar Illit colony, CAF directly procured

sniper scopes, camouflage suits, night-vision binoculars, a thermal imager and shooting

mats so that Israeli settlers could intimidate or shoot Palestinian Arabs moving through

newly captured land. The shipment of military hardware from the US to Israel was to be

expedited via signed letter from a commander in the Israeli Defense Force (IDF) in order

to guarantee “end user” clearance for arms exportation from the U.S. State

Department.

Exhibit 2: Tax Exempt Donation Laundering for Beitar Illit Arms Purchases

(Source: IRmep 2005 "Ten Things Every American can do to Improve US Middle East

Policy)

Operating in the Open

Not all illegal settlement funding flows from the US are the product

of money laundering. A large number of organizations openly raise and disburse funds for

the Israeli colonization of Palestinian territories. Although most misrepresent these

activities to the IRS as "educational" activities, others, such as the One

Israel Fund, Inc. of Cedarhurst openly tout their efforts to transfer, arm, and promote

Jewish settlements in occupied territories.

Exhibit 3: US Tax Exempt Donors to Illegal

Settlements

(Source: Internal Revenue Service)

US

Tax-Exempt Organization |

Tax

Exempt Mandate |

Activity |

Christian

Friends of Israel

(Colorado

Springs,

CO) |

"Educating

Christians about the Land of Israel and Biblical

significance of current events in the Middle East" |

Disbursed

$100,061 to an affiliate operating in the West Bank for

construction of bus stops, playground equipment in illegal settlements during the year

2003. |

American Friends

of the College of Judea and Samaria

(Brooklyn, NY) |

"To provide

support for the expansion and furtherance of the needs of educational institutions in Israel." |

Disbursed

$228,200 to an Israeli college established in the illegal West Bank settlement of

Ariel. |

One Israel Fund,

Inc.

(Cedarhurst, NY) |

"The

mission of One Israel Fund is to provide essential humanitarian assistance to the over

225,000 men, women and children living in the 150 plus communities throughout Judea, Samaria and Gaza

(YESHA)." |

Disbursed $1.9

million in year 2003 to finance illegal settlements, arms,

"Friends of the IDF" organization, and "security equipment". |

Although not all charitable donations to Israel are spent on

financing illegal colonization and violence, funds not earmarked for arms or land grab

campaigns offset expenses otherwise paid for by the Israeli government, freeing up

fungible resources used for encroachment on Palestinian lands. US charitable contributions

have also been used to ensure that settlements continue to spread in occupied territories

irrespective of Israeli and international laws.

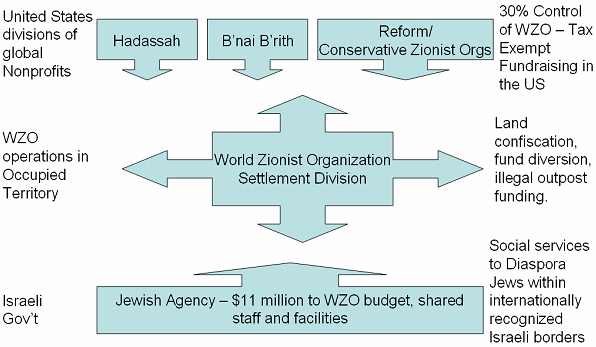

US Nonprofit Involvement in Illegal Settlement Coordination

American nonprofit organizations control 30% of the World Zionist Organization (WZO)

through intermediary governing bodies. On March 9, 2005, Talia Sasson, formerly Israel's

chief criminal prosecutor, reported that WZO was deeply involved in coordinating

confiscation of privately owned Palestinian land, diverting funds to illegal settlement

activity, and acting as the central coordinator for settlement financing and expansion.

(See Exhibit #4) WZO activities documented in the Sasson report violate international

and Israeli laws, as well as American laws prohibiting hostilities against territories or

people with which the US is at peace.

Exhibit 4: US Nonprofit Control of the World Zionist

Organization Settlement Division

(Source: Forward )

The United States does not escape from the consequences of

"charity" financed ethnic cleansing of the Palestinians. While

Palestinians have not struck back at soft US targets in retaliation, "homeland

stakeholders" sympathetic to the Palestinian cause, such as 9/11 mastermind Khalid

Shaikh Mohammed have.

“Yousef's instant notoriety as the mastermind of the 1993

World Trade Center bombing inspired KSM to become involved in planning attacks against the

United States. By his own account, KSM's animus toward the United States stemmed not

from his experiences there as a student, but rather from his violent disagreement with US

foreign policy favoring Israel.”—9/11 Commission Report

The vicious cycle of illegal settlement

funding/occupation/retaliation against the US has now become too obvious to deny or

explain away. US law enforcement is the best solution for confronting charities operating

in the US and laundering tax exempt donations into illegal settlement activity.

Avenues of Prosecution

Prior to 9/11 the US largely ignored charitable contributions flowing through the global

financial system. Monitoring became a priority after 9/11 in US Treasury Department

initiatives to confront "terrorism financing" through the department's Office of

Foreign Assets Control. However, the US has not done enough to stifle a less obvious but

critical terrorism generator: Israeli settler violence and illegal seizure of lands

Palestinians consider their homeland. Fortunately, effective avenues for the prosecution

of US charities funneling financial and other forms of support to illegal Israeli

settlements already exist in US criminal code. (See Exhibit #3)

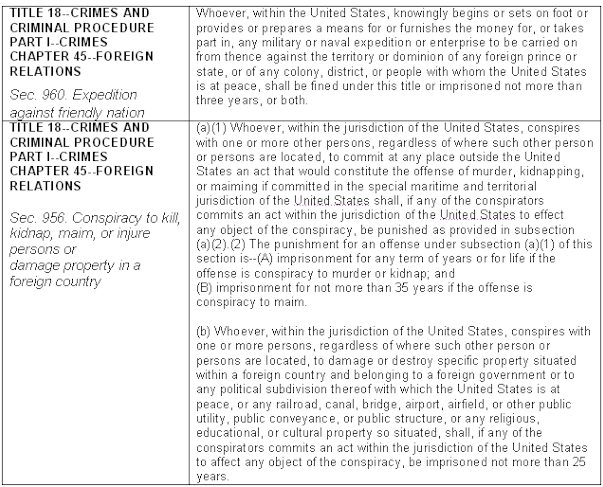

Exhibit 5: US Criminal Code – Charitable Funding of Occupation and Violence

(Source: Find Law – October, 2005)

Charities laundering donations from the US can be prosecuted for

their direct or indirect role in acts of property damage, confiscation, occupation and

violence against a nation, the Palestinians, with which the US is at peace. The only

question is whether Federal prosecutors will begin to enforce US law through criminal

prosecutions.

Recommendations:

US agencies must begin to take a number of coordinated steps to interrupt the flow of US

charitable dollars financing occupation and violence:

1. Internal Revenue Service: IRS disclosure forms 990

and schedule A reporting should be revised with specific questions about settlement

funding, such as: Did your organization finance or in any way participate in illegal

settlement activities in Israeli occupied territories? Examinations of US charities

sending large amounts of funds or equipment to Israel should become an IRS audit priority.

2. US Treasury Department Office of Foreign Assets Control:

Should begin to break out and make public charitable financial flows from the US to

Israel, as well as require donor entity activity reports documenting the purposes for

which donations will be used and location.

3. Indictments and Prosecution: Palestinians who have

lost life, limb or lands are eager to testify as witnesses for US attorneys criminally

prosecuting US non-profits violating Title 18 prohibitions of violence and occupation

against nations with which the US is at peace. AG's should seek at least five (5) criminal

indictments in 2006 against the most flagrant violators to send a strong message that US

counter terrorism efforts also aim to stamp out indirect causes of terrorism financed with

charitable donations.

Distribution

v |

President |

v |

House of

Representatives |

v |

Senate |

v |

State Department |

|

Department of

Defense |

v |

Department of

Justice |

v |

Public |

v |

Foreign Diplomatic

Representatives |

v |

US Attorneys |

v |

UN |

v |

Congress Watch level

supporters |

Notes

"No one knows full cost of Israel's

settlement ambitions" USA Today, 8/14/2005,

http://www.usatoday.com/news/world/2005-08-14-israelsettlercosts_x.htm

"Summary of the

Opinion Concerning Unauthorized Outposts" , 3/10/2005, Talia Sasson

http://domino.un.org/UNISPAL.NSF/0/956aa60f2a7bd6a185256fc0006305f4?OpenDocument

"Dying to Win: The

Strategic Logic of Suicide Terrorism" Robert Pape

http://www.amazon.com/exec/obidos/tg/detail/-/1400063175/103-1676732-6156641?v=glance

"How many Filings,

how much Revenue?" National Public Radio, All Things Considered, November 12,

2004.

"Senatorial

Courtesy", 8/26/2005, Lou Dubose, Texas

Observer http://www.texasobserver.org/showArticle.asp?ArticleID=2016

"Jewish Officials

Profess Shock Over Report on Zionist Body", 3/18/2005, Forward,

http://www.jafi.org.il/papers/2005/march/march18afor.htm

"The 9/11 Commission

Report" page 147 http://www.gpoaccess.gov/911/

Document URL:

http://IRmep.org/tec.htm

|

Sign

up for IRmep's periodic email bulletins!

Sign

up for IRmep's periodic email bulletins! Sign

up for IRmep's periodic email bulletins!

Sign

up for IRmep's periodic email bulletins!