AIPAC's

Fed Candidate Stanley Fischer on a Warpath

against Iran

Dual-citizen nominee's

lifetime benefit to Israel comes at a heavy

cost to America

By Grant F. Smith, Director of Research, IRmep

The rushed

campaign to insert Stanley Fischer straight from his position leading

Israel's central bank into the number two spot at the Federal Reserve

has allowed little time for research into the appointee's career or for

informed public debate about his record. Like the failed recent Obama

administration-Israel lobby pincer move to ram approval for U.S.

military strikes on Syria through Congress, avoiding such due diligence

through velocity may actually be the only means for successful Senate

confirmation. The rushed

campaign to insert Stanley Fischer straight from his position leading

Israel's central bank into the number two spot at the Federal Reserve

has allowed little time for research into the appointee's career or for

informed public debate about his record. Like the failed recent Obama

administration-Israel lobby pincer move to ram approval for U.S.

military strikes on Syria through Congress, avoiding such due diligence

through velocity may actually be the only means for successful Senate

confirmation.

Some of Fischer's accomplishments—from co-authoring

a seminal textbook on macroeconomics to handling economic crisis at the

IMF have—not surprisingly—been recalled by his many supporters. Other

doings that shed light on Fischer's controversial attributes—such as

overhauling how U.S. aid and trade packages are delivered to Israel—have

been mostly ignored. Appointing an openly dual Israeli-American citizen

into the most important central bank in the world could be a watershed

moment. While the doors of federal government have long swung open for

Israel-lobby appointees focusing most—if not all—their energies on

advancing the interests of a foreign state, any who were actually

Israeli dual citizens have traditionally kept that a closely-guarded

secret. Fischer's long-term boosters, including the American Israel

Public Affairs Committee (AIPAC), likely want to accustom Americans to

openly dual citizens circulating between top roles in the U.S. and

Israeli governments. A closer examination of Fischer reveals that

average Americans have good reason to oppose his appointment, because

his lifelong achievements for Israel have imposed high costs and few

benefits to the United States while making peace more difficult to

achieve.

Economics Economics

Stanley Fischer was born in Northern Rhodesia in

1943. He studied at London School of Economics and received a PhD in

economics from MIT. He taught and chaired the MIT economics department

and co-authored a leading macroeconomics textbook with Rudiger Dornbusch.

Fischer joined the World Bank in 1988 and became the first deputy

managing director of the International Monetary Fund (IMF) in 1994. He

oversaw emergency bailout lending and austerity programs over Mexico,

Thailand, Indonesia, Russia, Brazil and Argentina. High flying

Citigroup—under the helm of Sanford "Sandy" Weill—recruited Fischer in

2002. There he rose to become vice president with a seven-figure pay

package.

Israel

Fischer has

not only been an ardent supporter of

Israel, his professional efforts began when he took sabbatical leave to

Israel in 1972 and 1976-1977. He was a visiting scholar at the Bank of

Israel in 1980. More importantly for Israel, Stanley Fischer won an

appointment to the Reagan administration's U.S.-Israel Joint Economic

Discussion Group that dealt with Israel's 1984-1985 economic crisis. In

October of 1984, Israeli Prime Minister Shimon Peres arrived in

Washington asking an initially reluctant Reagan Administration for an

additional $1.5 billion in U.S. emergency funding—over and above the

already-promised aid $5.6 billion aid package.The help amounted to U.S. taxpayers funding each Israeli citizen

$1,650. Another key component of the plan called for a largely

unilateral lowering of U.S. tariffs and trade barriers to Israel, a

program initially called "Duty

Free Treatment for U.S. Imports from Israel" but later repackaged

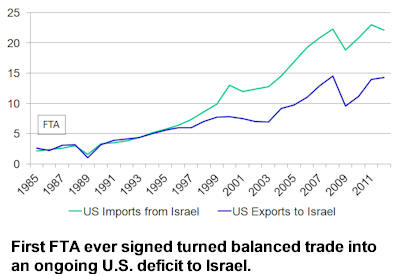

and sold as America's first "free trade" agreement. Over time the FTA

reversed a previously balanced U.S.-Israel trading relationship for one

that has produced a

cumulative deficit to the U.S. that passed $100 billion in 2013.

Seventy American industry groups opposed to the give-away in 1984 were

disenfranchised when Israeli Economics Minister Dan Halpern and AIPAC

illegally obtained a classified compendium of their industry, market and

trade secrets to use against them in lobbying and public relations. An

FBI espionage and theft of government property investigation was quashed

before it could narrow in on those inside the U.S. government who

delivered the secrets to Halpern.

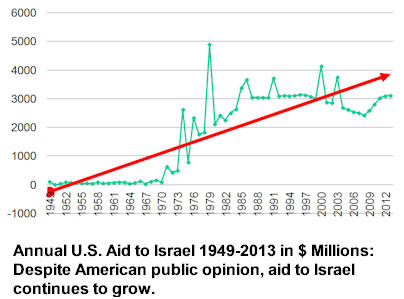

The

U.S.-Israel Joint Economic Discussion Group fundamentally transformed

U.S. aid to Israel forever. Before the Reagan administration, most U.S.

aid to Israel took the form of loans that had to be repaid with

interest. After the input of Fischer's team, subsequent U.S. aid was

delivered in the form of outright grants paid directly from the U.S.

Treasury—never to be repaid or conditioned when Israel took actions the

U.S. opposed. The

U.S.-Israel Joint Economic Discussion Group fundamentally transformed

U.S. aid to Israel forever. Before the Reagan administration, most U.S.

aid to Israel took the form of loans that had to be repaid with

interest. After the input of Fischer's team, subsequent U.S. aid was

delivered in the form of outright grants paid directly from the U.S.

Treasury—never to be repaid or conditioned when Israel took actions the

U.S. opposed.

Like many of Fischer's later IMF austerity

programs, the Joint Discussion Group initially announced that strings

attached to the aid would make it temporary. Secretary of State George

Shultz insisted during a 1985 address to AIPAC that "Israel must pull

itself out of its present economic trauma . . . . No one can do it for

them . . .our help will be of little avail if Israel does not take the

necessary steps to cut government spending, improve productivity, open

up its economy and strengthen the mechanisms of economic policy. Israel

and its government must make the hard decisions. Shultz wanted to make the huge American cash

transfer conditional on major Israeli economic reforms, but intense

AIPAC lobbying in Congress threatened to make the State Department

influence irrelevant. In the end, Congress delivered aid without

Israeli sacrifices, such as selling off bloated state-owned industries

and spending belt-tightening. The proposed privatization of $5 billion

in state enterprises threatened too much bureaucratic "turf" and too

many jobs, so Israel put them on hold. Fischer apologetically

characterized the Likud years as a "wasted opportunity by a government

that should have known better.Not until 1996 were Fischer's proscribed economic remedies adopted by

American neoconservative consultants to Benjamin Netanyahu as minor

points in the "Clean Break"

manifesto for Israeli regional hegemony. They remain among the few

unimplemented tasks in a plan that called for military action against

Iraq, Syria, and Lebanon.

Despite the

absence of any real economic reforms that would take Israel off the

American taxpayer dole, Fischer co-wrote a blustering 1986 article for

the Wall Street Journal called "Israel Has Made Aid Work" that AIPAC

circulated widely as

an official memorandum of its achievements. "Israel is the largest

single recipient of economic aid from the U.S. This is partly because

the economic stability of Israel is uncertain and is important to U.S.

national interests. Therefore a report on the progress of the Israeli

economy is relevant to policy decisions to be made here." Fischer never

bothered to substantiate his premise, that U.S. national interests were

somehow served by the bailout or that any aid given to Israel produced

tangible benefits. Instead Fischer delivered a fusillade of dry and all

but unreadable statistics about Israel's temporary economic

performance. Issues of long-term importance to most Americans, such as

returning U.S. aid to the traditional format of loans to be repaid and

the likely impact of the FTA on U.S. jobs went unaddressed by Fischer.

Fischer's core achievement—that the transformation of aid from loans to

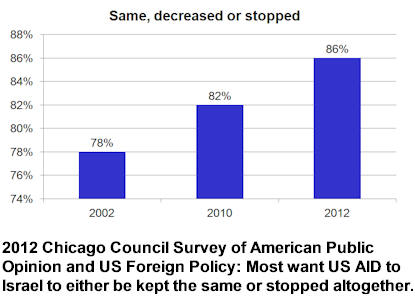

outright taxpayer give-aways—has been unchanged since 1986. The

premises behind this ever-increasing entitlement and one-sided FTA

performance are likewise never reexamined by Congress—despite the fact

that a majority of polled Americans have come to oppose aid increases to

Israel. Fischer's rare admonitions that Israel be held to account,

unlike the economies he transformed through biting IMF austerity

programs, have remained nothing more than lip service. Despite the

absence of any real economic reforms that would take Israel off the

American taxpayer dole, Fischer co-wrote a blustering 1986 article for

the Wall Street Journal called "Israel Has Made Aid Work" that AIPAC

circulated widely as

an official memorandum of its achievements. "Israel is the largest

single recipient of economic aid from the U.S. This is partly because

the economic stability of Israel is uncertain and is important to U.S.

national interests. Therefore a report on the progress of the Israeli

economy is relevant to policy decisions to be made here." Fischer never

bothered to substantiate his premise, that U.S. national interests were

somehow served by the bailout or that any aid given to Israel produced

tangible benefits. Instead Fischer delivered a fusillade of dry and all

but unreadable statistics about Israel's temporary economic

performance. Issues of long-term importance to most Americans, such as

returning U.S. aid to the traditional format of loans to be repaid and

the likely impact of the FTA on U.S. jobs went unaddressed by Fischer.

Fischer's core achievement—that the transformation of aid from loans to

outright taxpayer give-aways—has been unchanged since 1986. The

premises behind this ever-increasing entitlement and one-sided FTA

performance are likewise never reexamined by Congress—despite the fact

that a majority of polled Americans have come to oppose aid increases to

Israel. Fischer's rare admonitions that Israel be held to account,

unlike the economies he transformed through biting IMF austerity

programs, have remained nothing more than lip service.

At the end of 2004 Israel's U.N. ambassador

recruited Fischer to become the head of Israel's central bank, asking,

"Why not be our governor? Fischer accepted and initially provided endless amusement to reporters

by insisting on speaking Hebrew during press conferences and refusing to

speak English. Initial concerns that Fischer's global stature and

experience would overshadow and chafe the relevant players in Israel

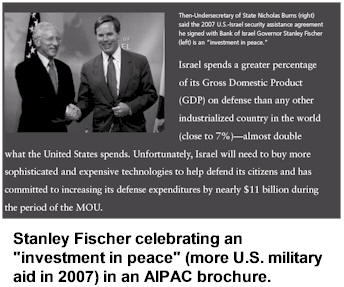

proved unfounded as Fischer moved energetically into his new role. AIPAC

continued to trumpet Fischer's accomplishments steering Israel through

the global financial crisis, though beneath the surface

he was

performing far more serious tasks for Israel and its global lobby.

Iran Sanctions Iran Sanctions

As Bank of Israel governor, Stanley Fischer played

a central role in coordinating the implementation of AIPAC-generated

sanctions against Iran—ostensibly over its nuclear program. Stuart

Levey, the head of the U.S. Treasury Department's division for

"Terrorism and Financial Intelligence," an office

created after heavy AIPAC lobbying, met often with Fischer in Israel

alongside the Prime Minister, Foreign Minister and chiefs of both the

Mossad and Shin Bet to explore how to "supplement" UN sanctions and

end-run Russian and Chinese opposition. The Levey-Fischer strategy was "to work outside the context of the

Security Council to engage the private sector and let it know about the

risks of doing business with Tehran" particularly against European banks

that had only partially drawn back their business dealings with Iran.

In 2010, Israel dispatched Fischer to meet with Chinese and Russian

"counterparts" in order to financially isolate Iran. Fischer's final official duties for the Israeli

government included drilling for "big crisis" scenarios—specifically,

Fischer told an Israeli television station—the unavoidable financial

fallout of a military attack on Iran. "We do plans, we do scenarios, we do exercises about how the central

[bank] will work in various situations.

After years targeting Iran, Fischer became convinced in his final months

in Israel that sanctions alone were not enough to collapse its economy.

Fischer reluctantly concluded that even as Iranian economic prospects

"continue to go down" the country would likely "find a way to continue

to keep economic life going. Fischer suddenly resigned and left the Bank of

Israel on June 30, before completing his second five-year term.

Israelis into the Fed and then where?

The last time

Fischer's name was floated to lead a major organization was during a

rushed Bush administration attempt at damage control. In 2007, the

controversial architect of the Iraq invasion and later World Bank

President Paul Wolfowitz was engulfed in an ethics scandal over his pay

and promotion package for Shaha Ali Riza. In two short years leading

the institution, Wolfowitz catalyzed the alienation of most divisions

within the bank and the distrust of economics ministries around the

world. Fischer, along with Robert Zoellick and Robert Kimmitt and a

handful of others, was considered as

an emergency replacement while the

administration and stakeholders strategized on how to ease Wolfowitz out

with a minimum of scandal.

In the end, Fischer stayed put in Israel. The last time

Fischer's name was floated to lead a major organization was during a

rushed Bush administration attempt at damage control. In 2007, the

controversial architect of the Iraq invasion and later World Bank

President Paul Wolfowitz was engulfed in an ethics scandal over his pay

and promotion package for Shaha Ali Riza. In two short years leading

the institution, Wolfowitz catalyzed the alienation of most divisions

within the bank and the distrust of economics ministries around the

world. Fischer, along with Robert Zoellick and Robert Kimmitt and a

handful of others, was considered as

an emergency replacement while the

administration and stakeholders strategized on how to ease Wolfowitz out

with a minimum of scandal.

In the end, Fischer stayed put in Israel.

It came as a surprise to many when The Wall Street

Journal and Israel's Channel 2 news simultaneously reported in early

December 2013 that the White House was "close to nominating" Fischer to

be appointee Janet Yellen's second-in-command at the U.S. central bank.

Media reports initially indicated that Fischer's

candidacy-to-Senate-confirmation would proceed on greased skids—with no

Senate debate—taking only a week so that the pair could quickly take

over the Fed in January. However, the Senate concluded its 2013

business without taking up the matter. The earliest date the measure

could be put up for a vote is January 6, 2014. Even that date might

slip since Senator Rand Paul and Minority Leader Mitch McConnell plan to

delay the vote unless a long-languishing measure to "Audit

the Fed" is also put up for a vote.

This rushed

approach has meant relatively little reporting on the deeper

implications of having an openly dual Israeli-American citizen a

heartbeat away from Fed chairmanship. That is unfortunate, since Israel

and its U.S. supporters have many hidden reasons for wanting stronger

influence at the Fed that they would likely prefer not to discuss.

That the Fed is a key player in Iran sanctions

implementation is certainly no secret. The Fed has been an equal

partner in levying hundreds of millions in fines against foreign banks

such as R.B.S, Barclays, Standard and Chartered and H.S.B.C. which were

charged with violating the Iran sanctions regime. Although AIPAC never

mentions it, American exporters have been seriously hurt by sanctions on

Iran and the punitive secondary boycott. A coalition representing the

US Chamber of Commerce, the Business Roundtable, Coalition for American

Trade, the National Foreign Trade Council and others urged Congress not

to enact sanctions provisions they estimated would cost

$25 billion and 210,000 American jobs. (PDF) Keeping such a costly

regime in place despite thawing relations and any hard evidence of an

Iranian nuclear weaponization program has therefore required immense

ongoing efforts by Israel lobbying groups. That the Fed is a key player in Iran sanctions

implementation is certainly no secret. The Fed has been an equal

partner in levying hundreds of millions in fines against foreign banks

such as R.B.S, Barclays, Standard and Chartered and H.S.B.C. which were

charged with violating the Iran sanctions regime. Although AIPAC never

mentions it, American exporters have been seriously hurt by sanctions on

Iran and the punitive secondary boycott. A coalition representing the

US Chamber of Commerce, the Business Roundtable, Coalition for American

Trade, the National Foreign Trade Council and others urged Congress not

to enact sanctions provisions they estimated would cost

$25 billion and 210,000 American jobs. (PDF) Keeping such a costly

regime in place despite thawing relations and any hard evidence of an

Iranian nuclear weaponization program has therefore required immense

ongoing efforts by Israel lobbying groups.

An equally important target for Fischer and Israel

may be—somewhat ironically given their pro-boycott programs—anti-boycott

activities. In the 1970-80s the Federal Reserve played an active "moral

suasion" role chastising and corralling U.S. banks away from any

activity that Israel construed as compliant with the Arab League

economic boycott. An expert with deep experience enforcing the

international boycott of Iran, Fischer is likely aware of the many

active American grass-roots campaigns aimed at ending the Israeli

occupation of Palestinians through targeted boycotts. These boycotts

range from efforts to get retailers to stop carrying manufactured goods

produced in the occupied West Bank (Ahava and Soda Stream), to

overturning contracts with firms providing services in occupied

territories (Veolia), to academic boycotts and even efforts to get labor

union pensions to divest from Israel bonds. Working more closely with

Israel and AIPAC, the Fed could become a vital node for reinterpreting

and enforcing old or new laws aimed at outlawing and punishing groups

organizing such grass-roots activities by targeting U.S. bank accounts

and freezing their financial flows.

Fischer may also want to launch "exercises" to

prepare the U.S. financial system for the fallout of Israeli military

attacks on Iran. New bills in Congress drafted by AIPAC call not only

for additional sanctions aimed at thwarting a fledgling deal on Iran's

nuclear program (favored 2-to-1 by Americans). AIPAC's bill forces the

U.S. to "have

Israel's back" in the event of a unilateral Israeli strike. If

Israel has already decided to attack Iran, it would benefit immensely

from having Fischer inside the Fed, protecting the financial flows

Israel now regards as all but a birthright from its primary global

underwriter. Less well-known is the Fed's authority to authorize foreign

bank acquisitions. Any future Israeli campaign to further entwine its

banks into the U.S. financial system through acquisitions would likely

find a much more welcoming regulator in Fischer.

Whatever the real

motivation for Fischer's sudden, inexplicably rushed insertion into the

Federal Reserve, it is also worthwhile to note longstanding Fed policies

have correctly considered U.S. citizenship to be preferable for at least

one key position, "because of the special nature of the supervisory

function, the need to ensure confidentiality of information, and the

delegated nature of the function." Unfortunately, that policy

preference covers only Fed

bank examiners rather than top leadership—the

Federal Reserve Act is silent on the wisdom of installing a

revolving door for returning U.S. citizens who took on dual citizenship as a

condition of serving a foreign government. Whatever the real

motivation for Fischer's sudden, inexplicably rushed insertion into the

Federal Reserve, it is also worthwhile to note longstanding Fed policies

have correctly considered U.S. citizenship to be preferable for at least

one key position, "because of the special nature of the supervisory

function, the need to ensure confidentiality of information, and the

delegated nature of the function." Unfortunately, that policy

preference covers only Fed

bank examiners rather than top leadership—the

Federal Reserve Act is silent on the wisdom of installing a

revolving door for returning U.S. citizens who took on dual citizenship as a

condition of serving a foreign government.

AIPAC, Fischer's co-author of harmful U.S. economic

policies on behalf of Israel, likely sees the Fischer appointment as an

important test case to assess American tolerance for openly dual

Israeli-American citizens running key U.S. federal agencies. In 2009

former AIPAC research director Martin Indyk, who was at the center of

AIPAC's research division during the FTA push,

said that "the US-Israel Free Trade Agreement served as a wedge that

opened up the Congress to free trade agreements across the world,

including the NAFTA agreement." Likewise, if Fischer can be "wedged"

into the Fed, it begs the question of why former Israeli ambassador to

the U.S. and historian Michael Oren could not someday lead the Near East

division of the State Department. From AIPAC's perspective, having

qualified Israelis directly run key divisions of the U.S. Treasury such

as Terrorism and Financial Intelligence, rather than indirectly through

AIPAC-vetted appointees such as Stuart Levey and his hand-picked

successor David Cohen, could probably boost the volume

of taxpayer give-aways

while improving coordination with Israel. Given AIPAC and Israel's

overly large influence on U.S. military initiatives in the region, the

lobby may now feel the moment is right for appointing Israeli generals

into the Joint Chiefs at the Department of Defense. This, AIPAC may

well reason, would be much more convenient than constantly arranging

visiting Israeli military and intelligence delegations that increasingly

serve as sole briefers (rather than DoD or the American intelligence

community) of members of the US Congress.

Soon after word of his Fed nomination spread,

Fischer again made uncharacteristically harsh statements about Israel at

an NYU Law School forum. As reported in

The Jewish Week, Fischer told the audience that Israel is not

seeking peace "to the extent that it should" and that it is "divided

between those who want to settle the West Bank and those who seek

peace." Fischer—who had every chance to pull U.S. and Israeli financial

levers that could have forced Israel out of occupied territories or

forced compliance with International law—never did. Adding to suspicion

that the statement was simply more empty "lip service" aimed at building

popular support among Americans tired of war, was the reporter of the

quote—former AIPAC lobbyist Douglas Bloomfield. In

1986 Bloomfield was grilled as a key suspect (PDF) in the 1985 FBI

investigation of AIPAC for espionage during the FTA negations

If Americans were ever polled on it—and they never

are—the majority who now object to increasing aid to Israel would also

likely object to quasi-governmental and governmental positions being

staffed by people who—by citizenship or sheer strength of identity

politics—are primarily occupied with advancing Israeli interests rather

than those of the United States. It is obvious that the real reason AIPAC and its economic luminaries such as Fischer never substantiate any

of the advertised benefits the U.S.-Israel "special relationship"

delivers to America in return for all of the costs is simple—there

simply aren't any. As greater numbers of Americans become aware that

the entire "special relationship" framework is sustained by nothing more

than Israel lobby campaign-finance and propaganda networks, the harder

the lobby will have to work to forcibly wedge operatives like Fischer

into positions where they can thwart growing public opposition—whether

it takes the form of boycotts or grassroots opposition to the U.S.

fighting more wars for Israel. In the very short term, Americans can

only fight such undue Israel lobby influence by again—like during the

drive to attack Syria—staging a mass action to demand their senators

reject Stanley Fischer's nomination.

[i] Oberdorfer, Don "Will U.S. Dollars Fix

Israel's Economy?" The Washington Post, June 9 1985

[ii] Oberdorfer, Don "Will U.S. Dollars Fix

Israel's Economy?" The Washington Post, June 9 1985

[iv] Maital, Shlomo "Stanley Fischer: the man

and the plan," The Jerusalem Report,

February 7, 2005

[v] BBC Monitoring Middle East, March 5, 2007

[vii] Williams, Dan "Iran Stepping Up Its

Atomic Efforts" - The Gazette, August

13, 2012

[viii] "Bank of Israel governor: Sanctions

won't collapse Iran economy. Islamic Republic will likely find

way to 'keep economic life going,' says Fischer in interview

with CNBC" The Jerusalem Post, October 24, 2012.

|